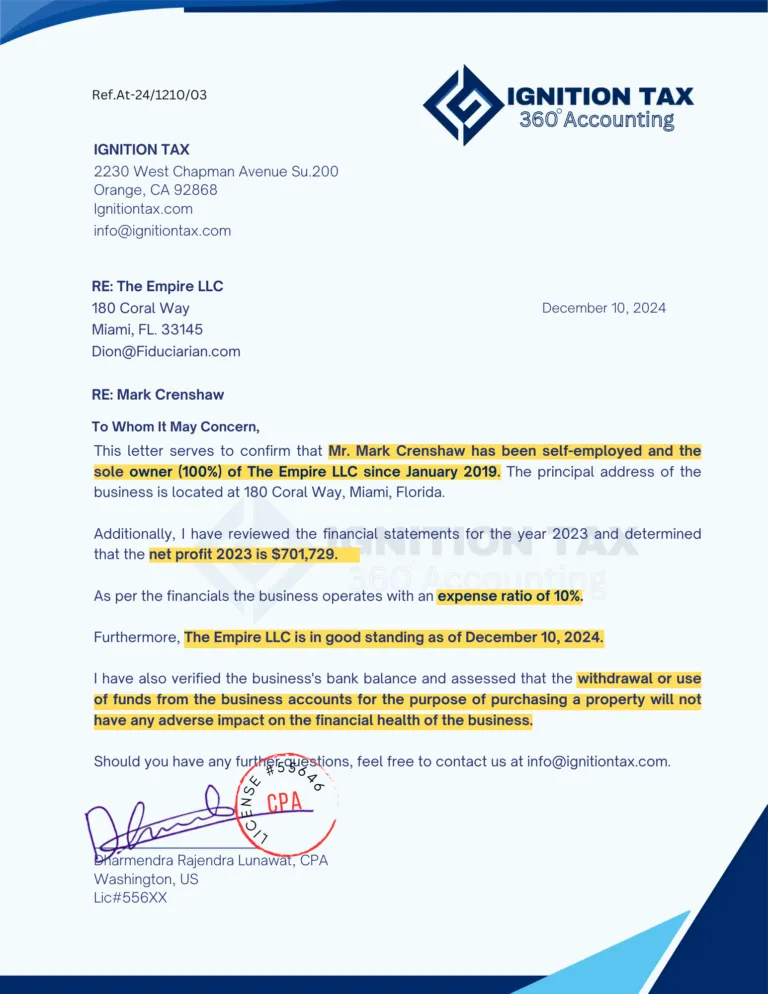

Mortgage Approval With Licensed CPA Letter in 2 Hours!

Are you self employed/business owners? Need a CPA letter for your mortgage? Licensed CPA write personalised letter with 100% Approval.

- No Bank Statement Required

- No Tax Return Required

Letter Verifies

- Business Details and Financials

- Self Employment Verification

- Other Custom Requirement by Lender

- Letter Validation to lender Provided

100% Approval or Get Refund

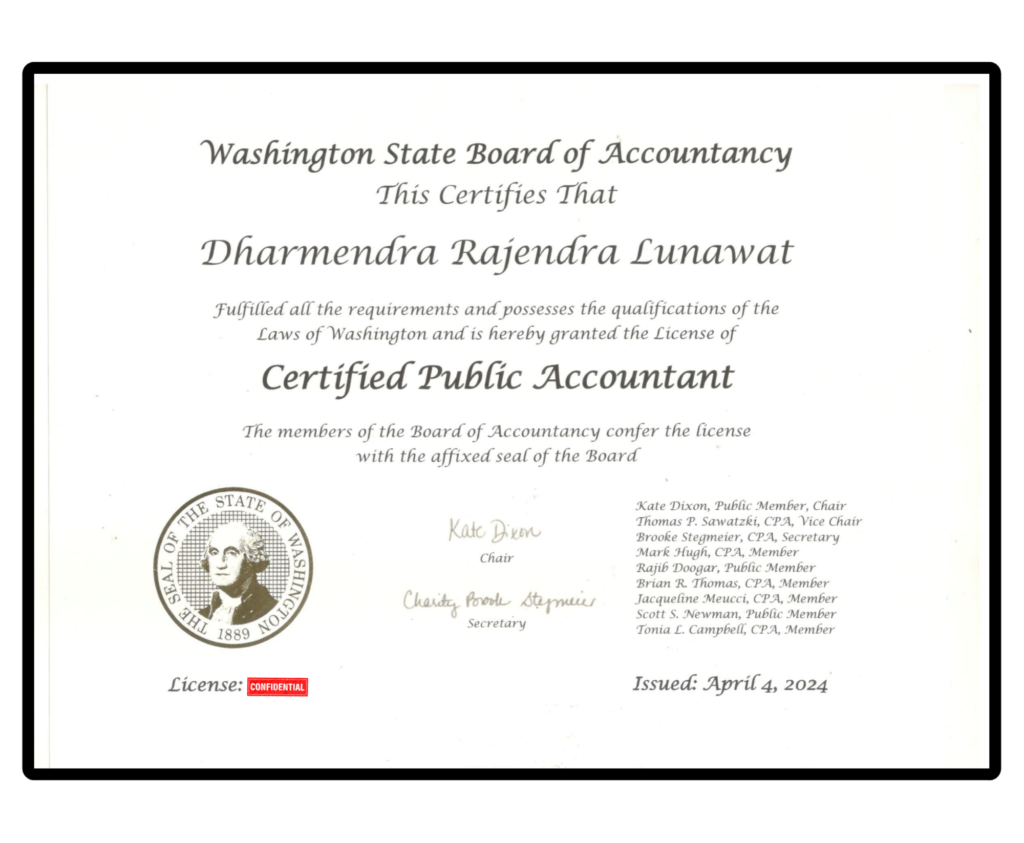

Licensed CPA

- No Bank Stat. Req.

- No Tax Return Req.

Letter Verifies

- Business Details and Financials

- Self Employment Verification

- Other Custom Requirement by Lender

- Letter Validation to lender Provided

Licensed CPA

100% Approval or Get Refund

How it works

-

1

Request Letter

Click the "Request" button to place your order easily.

-

2

Checkout

Complete the checkout process to confirm your order.

-

3

Submit Details

Fill out the form after checkout and get live portal access.

-

4

Order Confirmation

You are all done, CPA will write your letter in 2 hours.

100% Letter Approvals

Letter Request

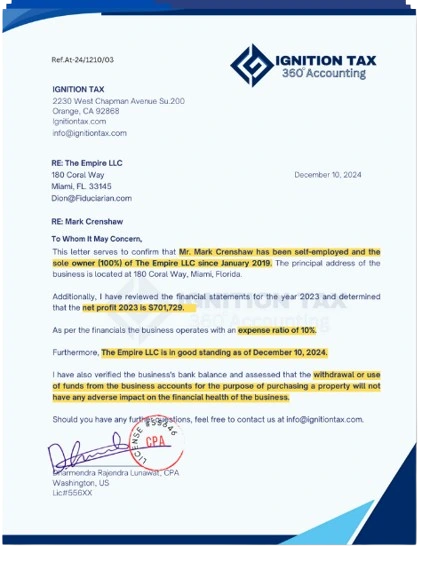

We are currently in the process of obtaining a mortgage loan, and the lender requires a CPA letter to verify the following details:

- Name of the Business

- Self-employment for a minimum of 2 years

- Applicant's Ownership Percentage

- Confirmation that the Business is Active

- Verification that the CPA has reviewed the Tax Returns or Financial Statements

Letter Request

Our lenders require a letter that verifies the business expense ratio, which is 15%. Additionally, the letter should state that “the use of business funds does not have any adverse impact on the business”.

Letter Request

We are currently in the process of fulfilling a request for our tenant, who requires a letter to verify the following details for housing purposes:

- Name of the Business

- Self-employment for a minimum of 2 years

- Applicant's Ownership Percentage

- Verification of Yearly Income ($280,000)

- Confirmation that the CPA has reviewed the financial statements for the previous year.

Our CPA-provided letters has an exceptional 100% approval rate. To date, we have successfully delivered over 1,100 letters, ensuring seamless approvals for our clients every time.

Why Choose Us for Your CPA Verified Letters?

As we are US Licensed CPA, we’re committed to making the process easy, reliable, and stress-free for you.

CPA take the time to create letters customized to your unique situation and prepared just for you.

Direct verification to your Lenders or Loan Officers.

Fast Delivery in Just 2 Hours.

Guaranteed Approval or Your Money Back.

How does it works

After purchase, you’ll receive the Letter Request Form. Complete and submit it as per your requirments, and the CPA will begin preparing your letter.

100% Approval or Get Refund

What CPA Letter Certify to Lenders/Loan Officers

Financial Position

- The Income for the year 2023 is $450,000

- Business operates on expense ratio of 15%

- CPA has reviewed the business financials or Tax Returns

- Use of Business Funds will not have any adverse impact on business operations

Business Ownership

- Mr. ABC owns 100% of AB Consulting LLC

- AB Consulting LLC is active from Jan 2023

- Mr. ABC Self Employed from 2 Years

- Business is Active on the location (Address)

Exployment Verification

- Mr. Jack working as a Chef since 2021

- CPA has reviewed the contract of his job

- Mr. Jack has hourly wage of $2,000

- Mr. Jack Yearly gross income $105,000

CPA Letter For Self Employed

For self-employed individuals, securing financial services like loans or mortgages can often be more complex than for those with traditional employment. One key document that can greatly assist in these processes is a CPA (Certified Public Accountant) letter. At Ignitiontax, we understand the unique challenges faced by self-employed professionals and the critical role a CPA letter can play in overcoming these challenges. This letter serves as a formal verification of your income and financial stability, providing the assurance lenders and other financial institutions need to proceed with confidence.

What Is a CPA Letter for the Self-Employed?

A CPA letter for self-employed individuals is a document issued by a Certified Public Accountant that confirms and verifies your income, business operations, and overall financial health. Unlike salaried employees, whose income can be easily verified through W-2 forms and pay stubs, self-employed individuals often have more complex financial situations. A CPA letter helps bridge this gap by providing a professional assessment of your financial status.

Why Do You Need a CPA Letter for Self-Employed?

1. Income Verification

One of the primary reasons lenders request a CPA letter is to verify your income. For self-employed individuals, income can fluctuate and may come from multiple sources. This variability can make it challenging for lenders to assess your financial stability. A CPA letter from Ignitiontax provides an accurate and credible verification of your income, reassuring lenders that your reported earnings are consistent with your financial records and tax returns.

2. Proving Financial Stability

Lenders and financial institutions want to ensure that you have the financial stability to meet your obligations, such as repaying a loan or mortgage. A CPA letter offers a detailed assessment of your financial health, including your business’s profitability, cash flow, and any liabilities. At Ignitiontax, we provide a thorough analysis in our CPA letters, demonstrating that you have the financial capacity to fulfill your commitments, which can be a deciding factor in the approval process.

3. Simplifying the Loan Application Process

The loan application process can be cumbersome for self-employed individuals due to the extensive documentation required to prove income and financial stability. A CPA letter simplifies this process by consolidating key financial information into a single document. This not only saves time but also makes it easier for lenders to review and assess your application. Ignitiontax ensures that our CPA letters are comprehensive and clear, providing all the necessary details in a format that lenders recognize and trust.

4. Enhancing Credibility

A CPA letter enhances the credibility of your loan or mortgage application. It shows that a qualified, independent professional has reviewed your financial information and can vouch for its accuracy. This added layer of assurance can significantly improve your chances of getting approved for a loan, especially if your financial situation is complex or if you have multiple income streams. At Ignitiontax, we understand the importance of credibility and take great care in preparing CPA letters that reflect the true state of your finances.

5. Meeting Lender Requirements

Many lenders have specific documentation requirements for self-employed borrowers, and a CPA letter is often one of them. Without this letter, your application may be delayed or even denied. By working with Ignitiontax, you can ensure that you meet all lender requirements, including providing a detailed CPA letter. This proactive approach can help prevent any potential issues that might arise during the application process.

6. Addressing Financial Complexity

Self-employed individuals often have more complex financial situations, with income derived from various sources such as business profits, investments, or freelance work. This complexity can make it difficult for lenders to get a clear picture of your financial health. A CPA letter helps to simplify this complexity by providing a concise summary of your financial situation, including any relevant details about your business operations. Ignitiontax specializes in handling complex financial situations and can provide a CPA letter that accurately reflects your unique circumstances.

7. Providing Peace of Mind

Applying for a loan or mortgage can be a stressful experience, particularly when you are self-employed. A CPA letter provides peace of mind by ensuring that your financial information is accurately presented and that you have the documentation needed to support your application. At Ignitiontax, we are committed to helping our clients navigate the financial landscape with confidence. Our CPA letters are designed to provide the assurance you need to move forward with your financial goals.

For self-employed individuals, a CPA letter is not just a helpful document—it is often essential for securing loans, mortgages, and other financial services. At Ignitiontax, we recognize the importance of this document and the difference it can make in your financial journey. Our CPA letters are crafted with precision and care, ensuring that they meet all lender requirements and accurately reflect your financial situation. Whether you’re applying for a mortgage, a business loan, or any other financial service, a CPA letter from Ignitiontax can provide the credibility, verification, and peace of mind you need to succeed.

If you’re self-employed and in need of a CPA letter, or if you have questions about how this document can support your financial endeavors, contact Ignitiontax today. We’re here to provide the expertise and support you need to achieve your financial goals.