480+ Loan Approved

Get CPA Letter in 2 Hours!

CPA will write letter verifying your self-employment, business ownership, and expense ratio for mortgage lender or bank requirements in just $245.

- No Bank Statement Required

- No Tax Return Required

- 100% Approval or Get Refund

Trusted by Leading Lenders

When Do You Need a CPA Letter?

Mortgage Loan Application

Banks or lenders require a CPA letter to verify your financials or business status for loan approval.

Income Verification

A CPA writes a letter confirming your earnings for various purposes, ensuring accurate income verification.

Business Expense Ratio

Need to verify your business expense ratio? This letter, requested by lenders or banks, confirms your working expenses.

For Apartment

Looking to lease or rent an apartment? A CPA can write a letter verifying your status for tenant or lender needs.

Self-Employment Verification

Certify your self-employment status with a CPA letter, ensuring 100% approval for your needs.

Business Ownership

Own a business? A CPA will write a letter confirming your business name, status, and ownership.

Employment Status

This letter, required by lenders or tenants, certifies your employment status, tenure, and wages.

Legal Purpose

A CPA can write a letter to meet your unique needs, whether legal, professional, or other purposes.

Milestone Payment

Request CPA to Write Your Letter in 4 Simple Steps

Get a professional CPA letter fast with our simple process to support your mortgage application with guaranteed approval

Milestone Payment

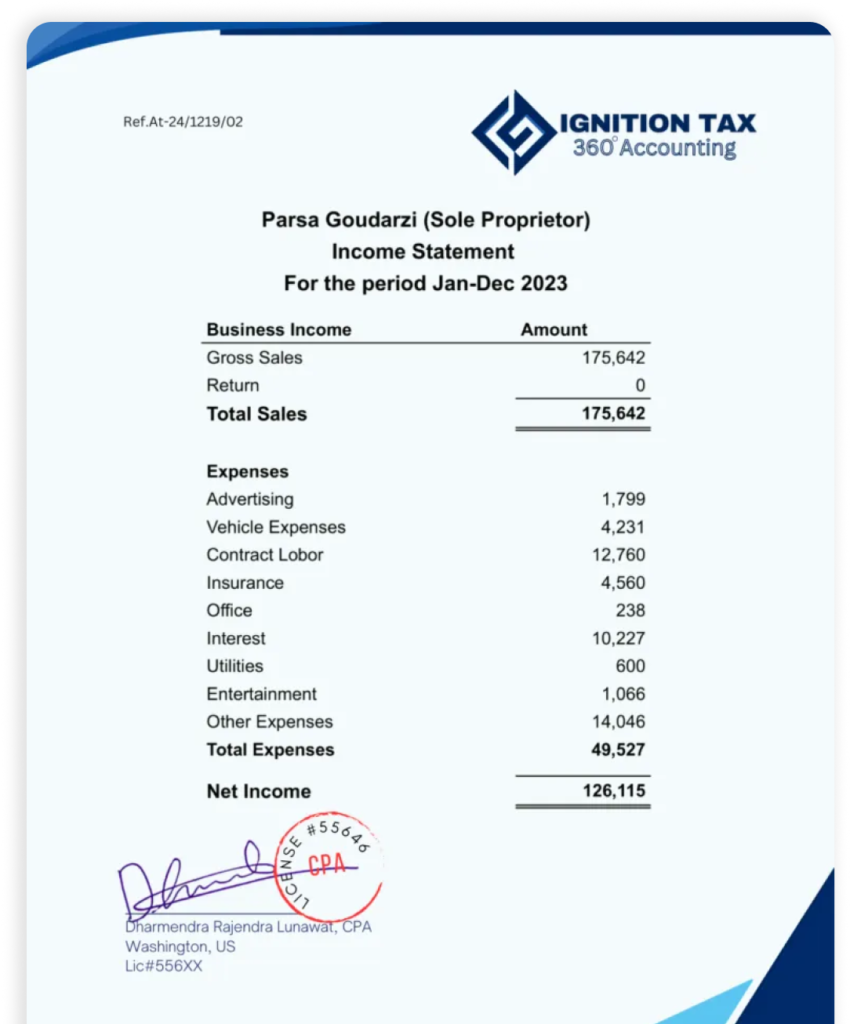

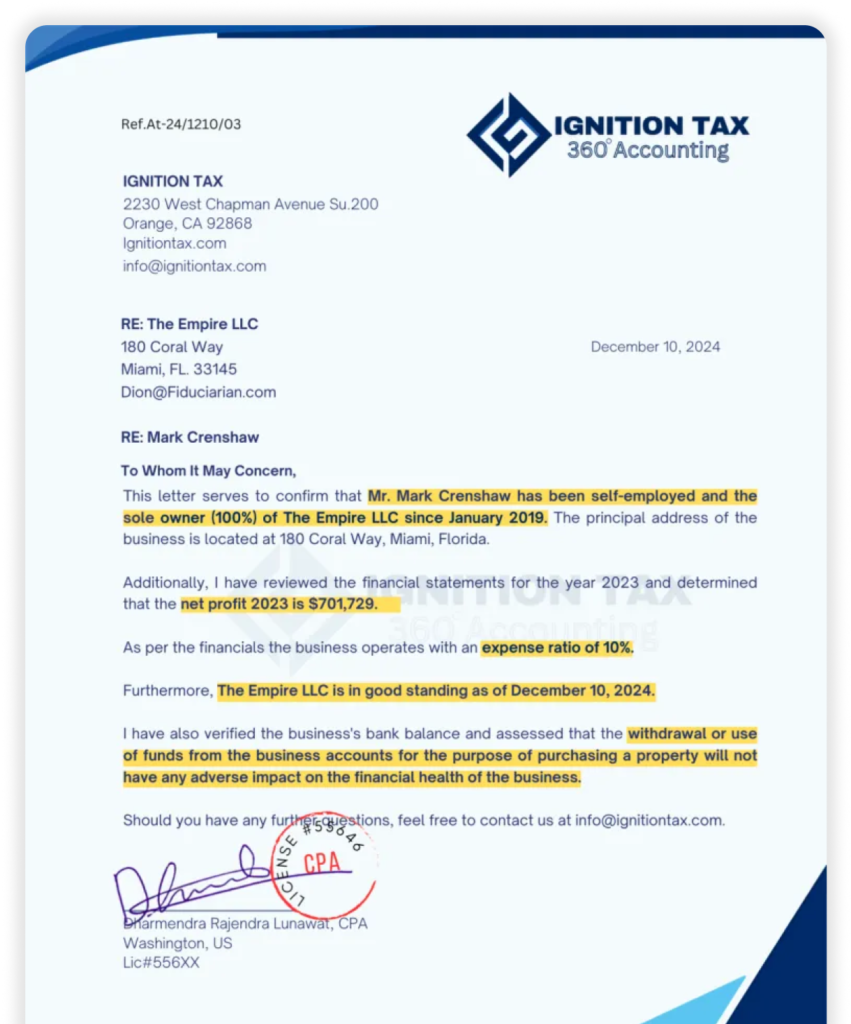

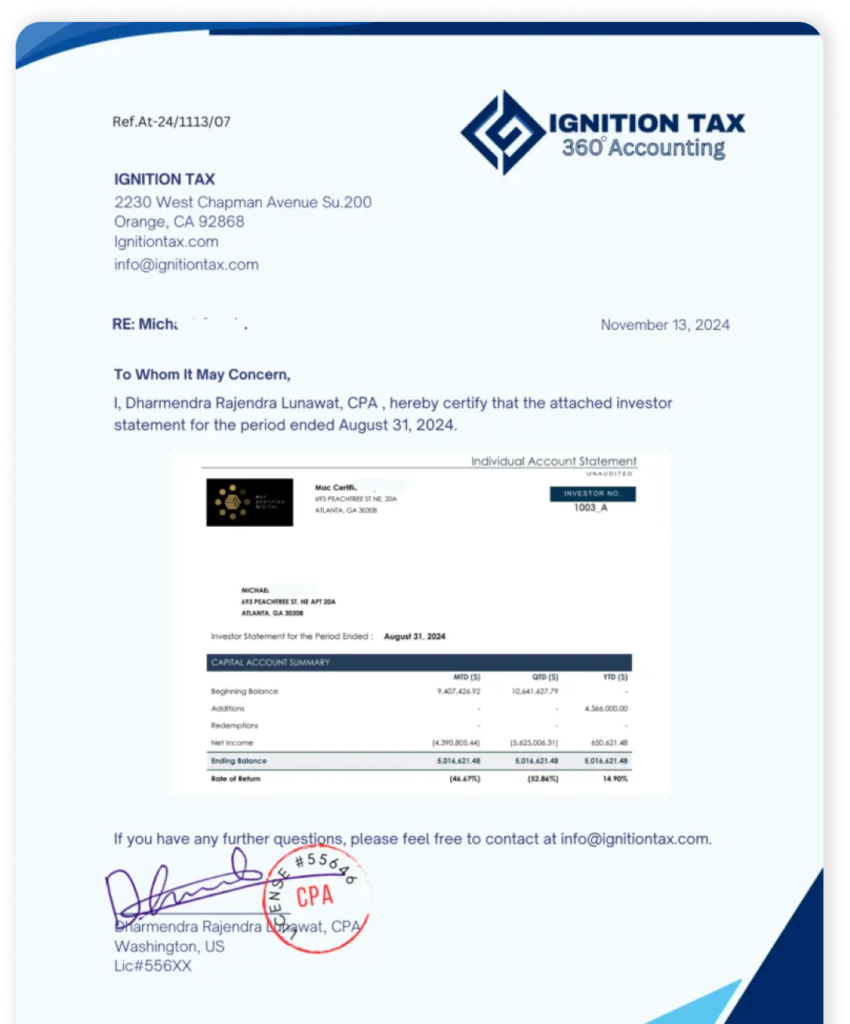

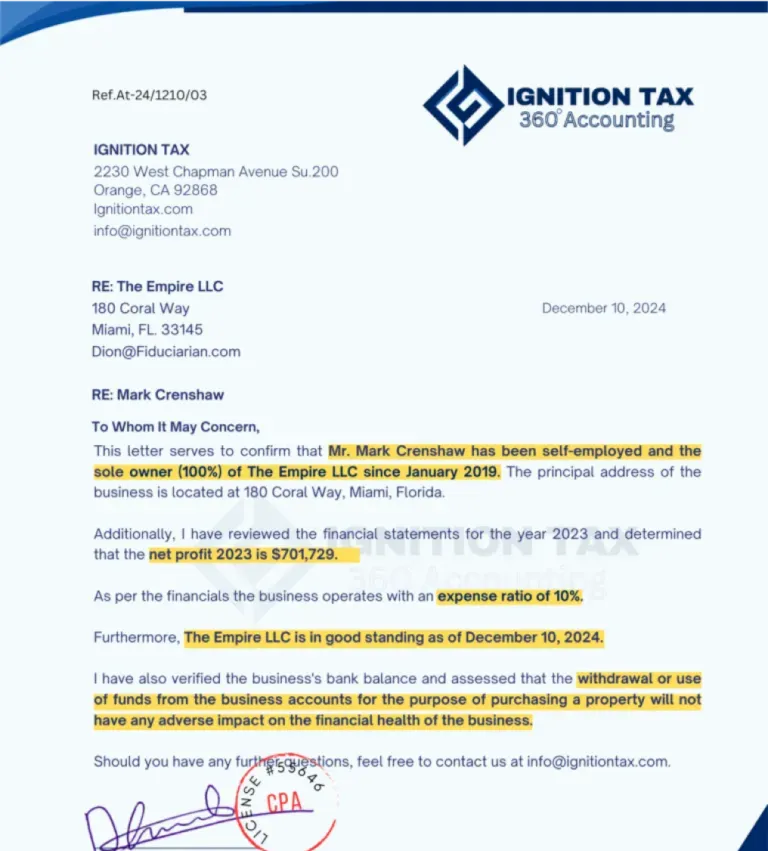

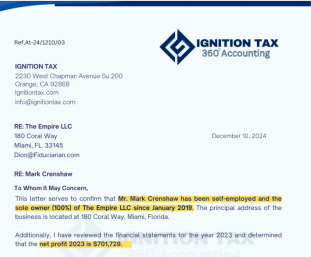

What Letter Verifies

A CPA Letter Verifies Self-Employment, Income, Business Ownership, Expenses, and More for Lenders and Institutions.

- Self Employment Verification

- Income Verification

- Business Ownership

- Financials Statement

- Accredited Investor Letter

- Expense Ratio

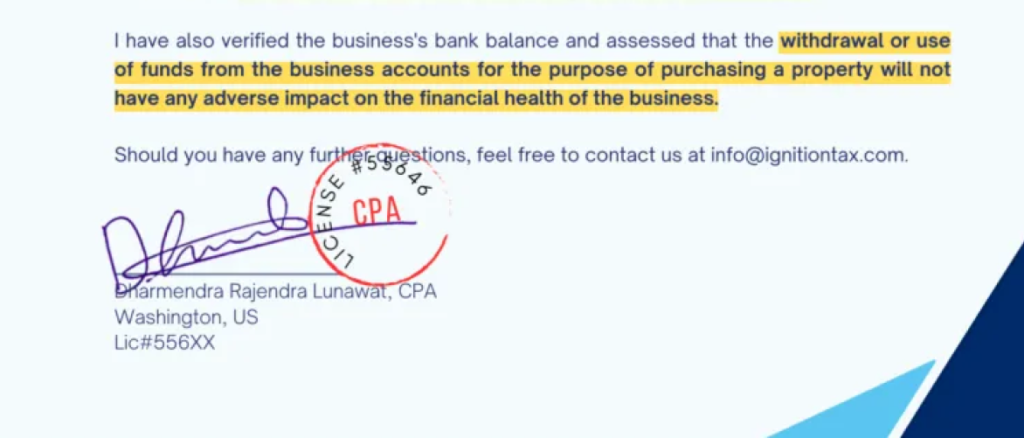

Certify Statement:

“Use of Business funds does not have any negative impacts on business operations”

“CPA has reviewed the financial statement or Tax Return for last 2 years”

Milestone Payment

Recent Loan Approvals

Our CPA-written letters boast a 100% approval rate with lenders nationwide. Below are some recent loan approvals secured by our clients.

Milestone Payment

Letter Request

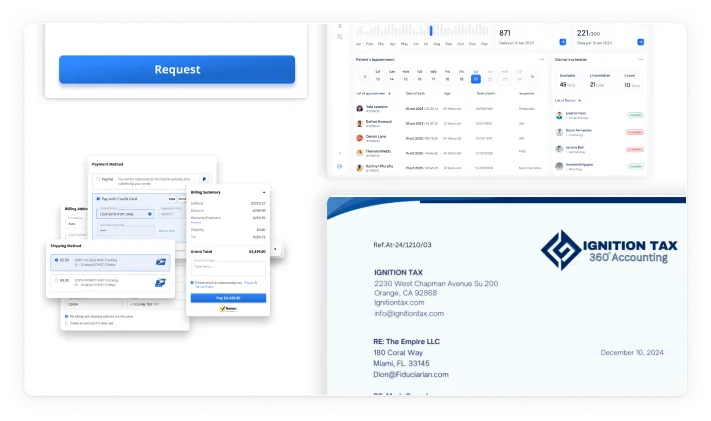

We are currently in the process of obtaining a mortgage loan, and the lender requires a CPA letter to verify the following details:

- Name of the Business

- Self-employment for a minimum of 2 years

- Applicant's Ownership Percentage

- Confirmation that the Business is Active

- Verification that the CPA has reviewed the Tax Returns or Financial Statements

Application Name:

Jack David

Verified By:

Letter Request

Our lenders require a letter that verifies the business expense ratio, which is 15%. Additionally, the letter should state that “the use of business funds does not have any adverse impact on the business”.

Application Name:

Jack David

Verified By:

Letter Request

We are currently in the process of fulfilling a request for our tenant, who requires a letter to verify the following details for housing purposes:

- Name of the Business

- Self-employment for a minimum of 2 years

- Applicant's Ownership Percentage

- Verification of Yearly Income ($280,000)

- Confirmation that the CPA has reviewed the financial statements for the previous year.

Application Name:

Jack David

Verified By:

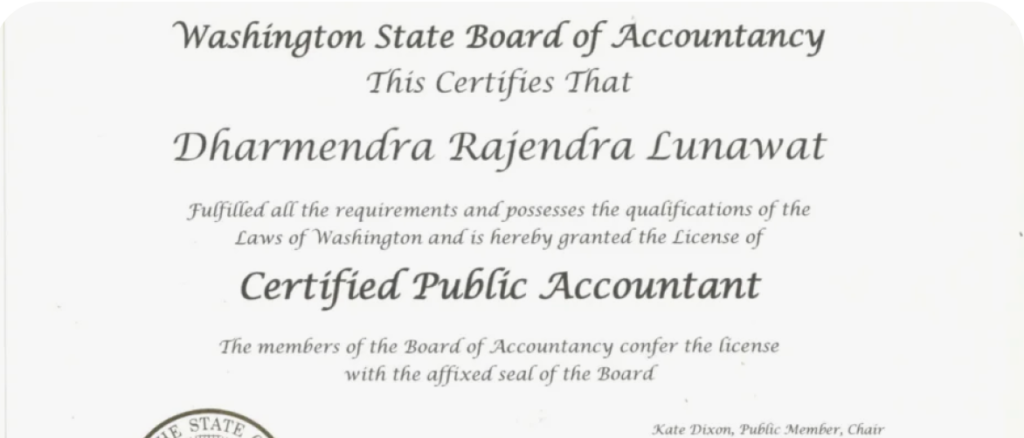

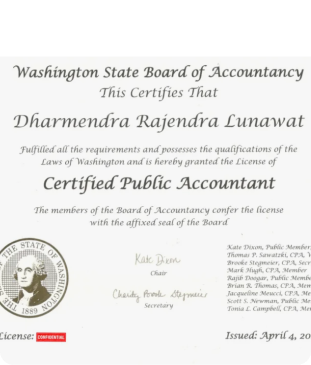

Why Choose Us for Your CPA Verified Letters?

As we are US Licensed CPA, we’re committed to making the process easy, reliable, and stress-free for you.

Every letter is carefully prepared, signed, and stamped by a licensed CPA. You can rest assured knowing it’s 100% legitimate and credible.

- Direct verification to your Lenders or Loan Officers.

- Fast Delivery in Just 2 Hours.

- Guaranteed Approval or Your Money Back

Milestone Payment

What CPA Letter Certify to Lenders/Loan Officers

A CPA letter verifies income, business activity, and employment, giving lenders the confidence to approve your application.

Milestone Payment

CPA Comfort Letter

A CPA Comfort Letter is essential for major financial decisions. At Ignitiontax, we provide trusted documents to secure loans, close deals, and ensure confidence in your transactions.

What Is a CPA Comfort Letter?

A CPA Comfort Letter, also known as a letter of assurance, is a document issued by a Certified Public Accountant that provides an independent verification of specific financial information. This letter is often requested by lenders, investors, or other stakeholders to confirm that the financial data presented is accurate, reliable, and compliant with applicable standards. It serves as a formal statement that the CPA has reviewed the relevant financial information and can attest to its validity.

Real Stories from Our Happy Clients!

Our users have us blushing! See what they’re saying about our CPA letters.

What would you like to know about Ignition Tax?

What’s a CPA letter?

A CPA letter is a document from a Certified Public Accountant that confirms your financial status or details. It’s often needed to reassure lenders or landlords about your financial reliability..

How much will a CPA letter cost?

A CPA letter for a mortgage costs $245 for standard service. Both options include unlimited revisions until your loan is approved.

What’s included in a CPA letter for the self-employed?

It covers income verification, self-employment status, and ownership percentage. For business partners, it also includes financial statement verification and details on how business funds are used.

How quickly can I get a CPA letter?

If you go for statnderd or Letter Plus services, you’ll recive your letter within 02 to 03 hours.

Why do lenders need a CPA letter?

Lenders use CPA letters to verify that you have a stable income and are financially sound enough to repay a loan.

Where can I get a CPA letter?

You can get a CPA letter from your current CPA or through Ignition Tax. They can provide the verification you need based on your financial documents.